European regulation called PSD2 (Payment Services Directive 2) enables bank customers to sign up for services outside the banking network to manage their bank account. Banks are obligated under this system to provide the customer’s credentials to the financial service provider whenever the data is requested. The United Kingdom was the first country to create this standard and it was later slowly adopted across the world. Financial data is extremely valuable and customers can leverage it to get better prices and services from multiple providers.

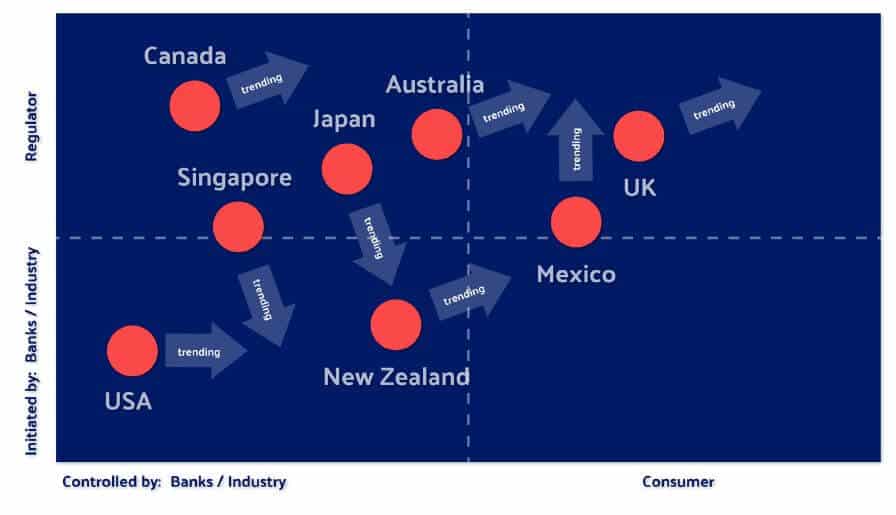

The report given below provides a brief overview of the open banking systems in place in the countries of Australia, New Zealand, Japan, Singapore, Mexico, the United States and Canada. The insight has been gleaned by numerous interactions with experts in these countries and compiled in the report below by Bud – A Money Management service provider.

Download the report below:

open-banking-report-2018