Niyo Bank Near Me, IFSC Code, Helpline Number

Niyo Bank is in trend for many of its products and has extended them in various segments of finance and banking too. These are introduced to keep jargon and difficult banking away from the real need and use of the banking sectors in our economy. It is a simpler, smarter and more secure way to integrate finance with technology. Niyo Bank is a type of Neobank. So, let us first understand what these neobanks are?

What is a Neobank?

Neobanks are fintech firms that operate digitally without any physical presence. Like you don’t even have an option to visit a branch and open an account or avail of any other service. It’s totally a cloud concept. Interesting, isn’t it? Neo banks are secure and time saving. They do not have bulky documentation and are way more convenient than traditional banks. With the help of AI these banks are providing all the fintech services at such a low cost. In the later sections, we will cover Niyo Bank IFSC code and Niyo Bank helpline number.

Advantages of Neobanks

Here are some perks of Neobanks:

The best thing about Neo bank is that it is online, which means it’s available 24×7. These are highly personalized, convenient and user friendly as that’s the only way for them to interact with their customers Clients with Neobank have access to all the banking services like bill payments, debit cards and credit cards, money transfers etc. Neo banks are highly secure and have more affordable services than any other bank.

Could anyone have imagined a bank going all online and breaking all stereotypes in one go along with providing all kinds of services just like it? Neo banks are not basic financial services but advanced level banks providing quick solutions around the clock. With everyone opting for a digital lifestyle Neo banks are the perfect fit in this scenario. And of course, if everything can be online why the financial sector is to be left out?

Neobanks Vs Traditional banks

Let us see how Neo banks compare with traditional ones. Also Read: 10 Best Banks for Business Loan in India

About Niyo Bank

Niyo solution Inc. was founded in 2015 by Virender Bisht along with Co-Founder Vinay Bhagri with the aim of providing Simplified finance with technology. Today, they have more than 170 million funding and over 2.5 million customers around the Globe. Niyo is working with a team of 800+ members day and night to bring this revolution successfully. Niyo is designed to have connectivity of banking in every corner of the World. It offers a lot of great services which are mainly categorized under six different sectors. We will talk about Niyo products, Niyo Bank IFSC code and Niyo Bank helpline number later. As Niyo Bank operates online, there is no point in searching ‘Niyo Bank near me’ as it is just a tap away. Niyo is in partnership with:

In Banking: DCB Bank, Equitas Small Finance Bank, ICICI Bank and Yes Bank. In Network: VISA, RuPay and Mastercard.

Features of Niyo Bank

Niyo Bank has got a lot of things that give it an edge over all the competitors out there. Niyo has marked itself as the best service provider with amazing services available.

Hassle free

Niyo facilities hassle completely digital customer acquisition and everything with a paperless process that is time efficient and budget friendly. No waiting or long queues just click on the app and enter into a world full of digitalization. It just takes five minutes to open a bank account. Isn’t that a thing to love it for, now? All you need is to go for eKYC and get your account instantly.

Seamless UI/UX

Niyo Bank is not just any other kind of app, it has got features like highly defined versions with great responsiveness. Other things they do have is facial recognition and fingerprint locking system to keep your apps secure. Niyo says they emphasize Seamless UI/UX along with that they have customer account management within the same app only. It also goes along with hand gestures to ease your working on the app. Hence, it’s a full package of modern technologies we need in our lives today.

Niche features

Niyo offers an amazing feature of keeping a track of transactions all around the world. Using Niyo one can pay anywhere around the globe without any forex markup charges. And you know what with Niyo things like ATM locker, real time blocking and unblocking of cards, location-based transaction risk monitoring, budget maintenance everything is free and in-built which no traditional or digital bank provides.

Properly managed banking services

Niyo Bank isn’t just a digital bank and it is known for its amazing offers. Though digital banking is famous for a decade, it never provided us with any service as compared to a Niyo Bank. Like a full-fledged online saving, current and all other kinds of accounts.

Multi bank integrations

This totally digital model has lower customer acquisition and servicing cost. Niyo offers all facilities such as prepaid cards, credit cards, Virtual accounts, Virtual corporate wallets, and much more. It has various partnerships to run around smoothly and increase qualitative services.

Products Offered by Niyo

Niyo has an amazing product range for its customers and is complaint free till now. Each of its products comes with something special to go on with. In this section, we will also cover Niyo Bank IFSC code and Niyo Bank helpline number.

1. Niyo Global SBM

Niyo Global is a blessing for international travelers all around the globe. With services like Zero markup in Forex, Free lounge access in India at domestic and international airports, and up to 5% interest per annum with a monthly payout for all the Global account clients. With zero markup one can save around 3-5% every time on Forex transactions. Also, it has 100+ Currencies that work in almost every country you can name of. See, how easy and amazing this chance is to save on your Forex transactions. So, at 20 transactions one is kind of free. It also provides you with a feature to locate ATMs. So, if you go out with minimal cash or if you have shopped more than your budget, who cares. Just locate a nearby ATM within seconds with Niyo. Other than these you can convert currency with Niyo in seconds too and in real time. Also, Niyo assures your transactions at the lowest charges available so you do not have to pay more for what it is worth. Also it offers you VISA concierge with 24×7 availability. Moreover you can stay updated with its amazing real time news feed. In case you’re not using your card or have misplaced it, lock it in real time that too you can do temporarily. Adding limits to your account and card swipes is an option as well to use here. They also offer DICGC insurance cover of up to Rs. 5 lakhs.

2. NiyoX Equitas

Niyo, in partnership with Equitas small finance bank, has been providing a service related to bank accounts with zero balance and zero commission on mutual funds transactions. This is not just a savings account; it’s a 2 in 1 account that is a savings and wealth account. Here you get the benefit of Zero Forex markup value on international spending. It is also amazing to be used for kids as they offer a maximum of Rs. 20,000 debit transaction a year with a daily limit of Rs. 5000 per day. With Niyo you can track your EPF balance within seconds by using your mobile number and OTP. Moreover, you can put your investment on auto mode. Spare your change and get it invested for free and effortlessly by Niyo. Hiding your balance is also possible with hand gestures. All this with utmost security. There is another option as well: register for Equitas Reward and get amazing deals and benefits. Get platinum Visa debit card at no cost with NiyoX. Anyone of more than 18 years can open an account. Niyo Bank IFSC code is STCB0000065. NiyoX is offering these following interests rates for saving account:

5% up to Rs. 1 lakh 6% for Rs. 1 Lakh to 5 Lakhs 7% for more than Rs. 5 Lakhs to 2 Crores. 5% above 2 Crores

3. NiyoX Salary Account

Another great thing NiyoX offers is a salary account. Again with Zero markup on Forex and Zero minimum balance you can have an account handy on your smartphone. Also here you can have a virtual debit card. Also, get rewards along with your salary from NiyoX. All you have to do is open an account, get a salary of more than Rs. 20000 and make an expense of Rs. 1200 onwards to get a scratch card. That’s amazing, isn’t it? All other features same as saving account are here too like auto investing mode, zero commission on mutual funds investments and managing your portfolio with the salary account only. NiyoX is offering these interests rates for salary account:

3.5% up to Rs. 1 lakh 6% for Rs. 1 Lakh to 5 Lakhs 7% for more than Rs. 5 Lakhs to 2 Crores. 5.5% above 2 Crores

4. Niyo DCB

Another great thing is Niyo DCB. An account Niyo has in partnership with DCB which you Global advantages. You can use this account in more than 160 countries with 90+ Currencies. Niyo offers you a Zero balance account with no markup cost, no cost of loading and no hidden charges. All you need to do is load your INR anytime from anywhere and spend it anytime and anywhere too. Loading is simple too with IMPS or NEFT. Also with this you have got 24/7 support, ATM locator and currency exchange rates everything in real time. Block your cards in real time too. Also, you can activate another card instantly if you have lost the original one. Hence, there is nothing to worry about in foreign travels, just enjoy yourself because Niyo is here to take care of your finances. Use it for fun, if you are a student take it for hassle free finances and make your business travels easier and sorted. Niyo DCB provides you amazing transferability among friends and family even internationally. This way’ Niyo Bank near me’ is really true and it’s the nearest thing to you.

5. Niyo Money

Niyo Money is an opportunity to invest with the best. It is a wealth management feature you can have at your fingertips with zero charges. Invest in Mutual funds, stocks and goals all from one place. More than 5000 mutual funds options are here to invest in. Create goals here, either short term or long term and track them with ease. Moreover, be right at your choice of investing because Niyo provides you with a selection strategy to follow and create more wealth. Get all the markets at one point. Applying for IPOs is also an option available in Niyo Money. For investing in intraday and F&O brokerage charge is Rs. 20 per trade. Also Read: Federal Bank Credit Card Apply Process

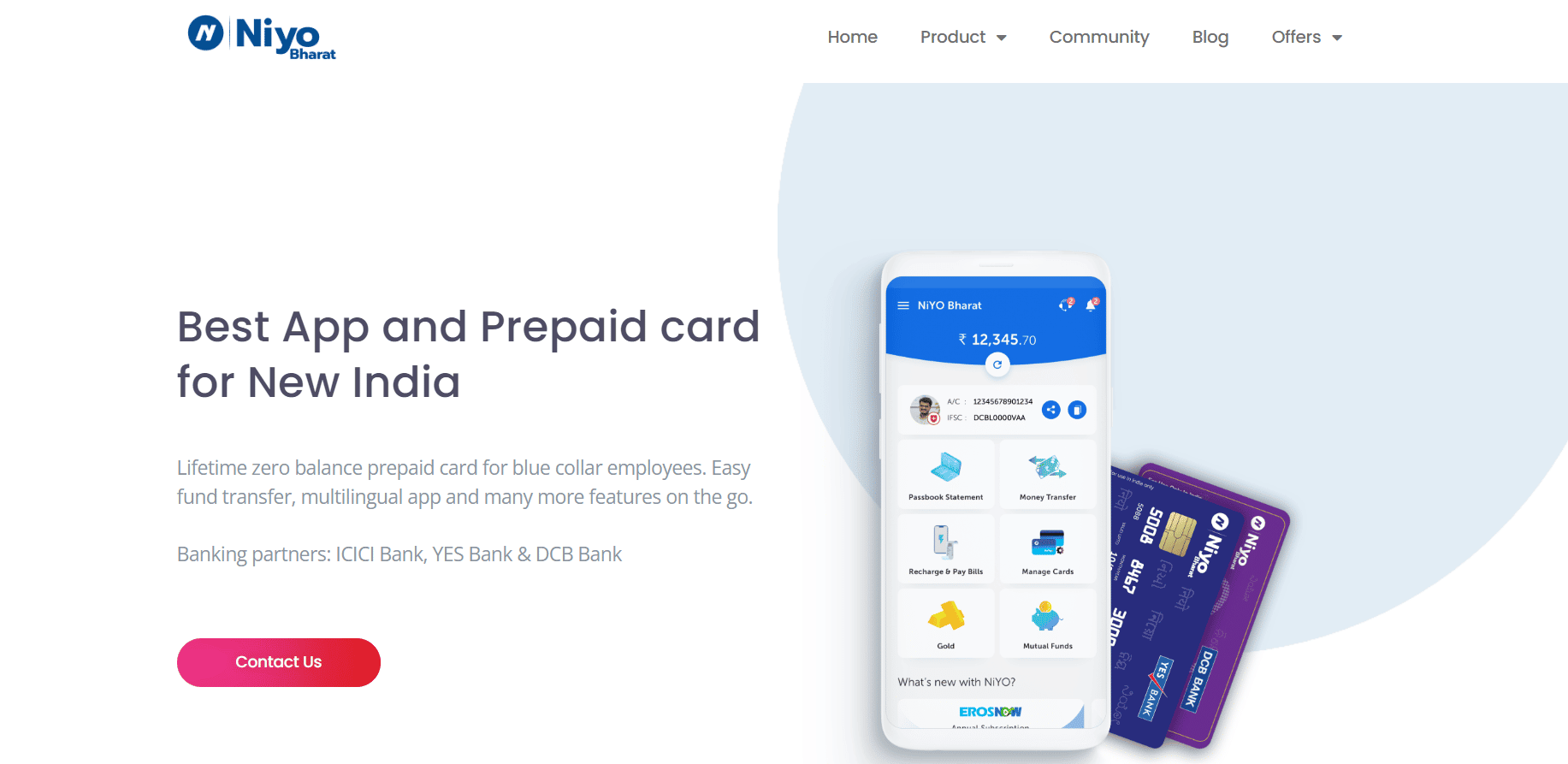

6. Niyo Bharat

Niyo Bharat offers you prepaid cards with lifetime zero balance especially for blue collar employees. With that, you can easily transfer funds and it can be used in multiple languages. This is a permanent card even if one switches jobs this can be used. Best part here is instant activation so no need to wait for days to get a prepaid card. There are amazing options like a single click to check your passbook along with any custom time and transactions you want. You can also get voice assistance features with a prepaid card. Using Niyo Bharat one can transfer instantly to any account and also to other Niyo customers in one click. Best part here is knowing your limit availability is updated after every transaction you make. You can reach Niyo Bank helpline number (Bharat) for customers at 18002583009 or mail them at care@goniyo.com. For corporates, Niyo Bank helpline number (Bharat) is 180025813010 and email them at corporate-support@goniyo.com.