ESAF MICROFINANCE

The company extends loans to women using the joint liability group model of lending and had operations concentrated predominantly in Kerala. ESAF had a network of 150 branches across 35 districts in the states of Kerala, Tamil Nadu, Chhattisgarh, and Madhya Pradesh as on March 31, 2013.

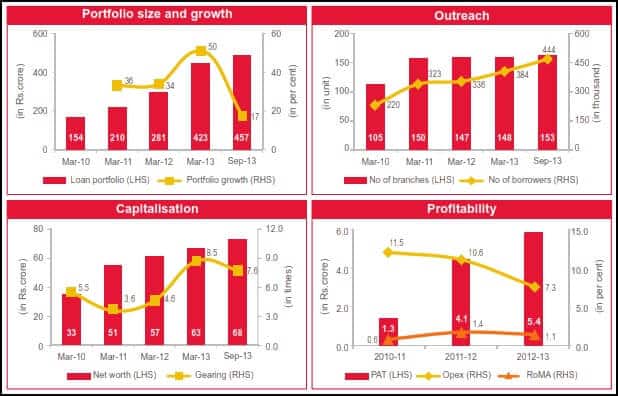

Performance on key parameters

The medium-sized MFI has a loan portfolio of Rs.457 crore as on September 30, 2013. Business growth has been higher than industry-average during the 3 years through March 2013; the loan portfolio and borrower base grew at a CAGR of nearly 39 percent and 20 percent respectively Asset quality is moderate; the 30+ dpd has remained at 1 to 2 percent during the three years ended March 31, 2013 The funding profile largely comprises loans from banks and NBFCs; has a relationship with a large number of lenders. The cost of borrowings is comparable with those of peers. Diversification into the capital market will help improve the funding profile over the medium term Capitalization is moderate; the gearing increased to over 8 times as on March 31, 2013, from 4.6 times, a year ago. The company, however, has recently raised capital to support its medium-term growth plans The earnings profile is moderate; the return on managed assets has remained over 1.0 percent during the past 2 years on the back of reducing operating expense ratio. The company’s ability to maintain its profitability over the medium term will be crucial.