With the advancement of technology, things have become pretty easier, and it also implies the financial markets as well. For example, there are numerous free investment portfolio trackers; with their help, you can keep track of all your investments without a hassle. You would no more have to juggle between different accounts as you just need to log in on the tracker and check everything related to your investments here. What is a Stock Portfolio Tracker? It is a tool that is used for tracking the fluctuation of securities that are held in your financial portfolio. On the tracker, you would be able to see how the prevailing allocation accumulates up with your long-term goals and examine how your portfolio is doing concerning the market. The trackers are easy to use, and they are equipped with powerful analytical tools plus, they are also combined with brokerages and stock screener tools. The good thing is that you would be able to track the stocks you have invested in and the ones in which you are interested. Other features of stock portfolio trackers are:

You can see how your current asset allocation regulates your financial objectives. It helps in comparing your portfolio’s performance with market benchmarks You would be able to see all your investment holdings in one location, making it facile for you to track your investment performance A few portfolio trackers will also show you vital information on the securities’ gain-loss statements by the multiple trades that have been made It will also show you how your securities are allocated to distinct market areas like energy, telecom, materials, paper, financials, medical, etc. and transitions in this allocation over time Some of the best portfolio trackers provide you with an alternative to add portfolios from your investment accounts or execute hand-operated portfolios to test-specific strategies.

What is the best Stock Portfolio Tracker?

There is a large pool of good portfolio trackers, but how would you know which is best for you. Here are a few things that you should check on before choosing the portfolio tracker:

- Cost: There are numerous stock portfolio trackers that you can use for free. Some platforms might have add-ons that can help you in trading, but it would depend on your requirement if you need them or not. If you are a newbie, then it is recommended for you to opt for the free trackers.

- Brokerages supported: If it does not support your brokerages, then it is no point using the tracker. Instead, opt for a portfolio that has easy integration with your broker.

- The number of trackable assets: If you trade in many cryptos, your requirements would be different from a large-cap trader, so think about your investment areas before choosing the tracker. A good tracker enables you to follow all types of investments such as stocks, bonds, ETFs, crypto, etc.

- Speed: Everyone looks for software or tool that loads quickly, and the same goes for the portfolio tracker. Always check the time the tracker takes to load on your phone or laptop, as speed is vital for getting price updates. You would not be able to trade if you get more than 10 minutes old prices. Hence, a tracker should post real-time stock quotes.

- Easy to use: This is the primary requirement while choosing the best stock portfolio trackers. The tracker that you choose should have a user-friendly interface, as you would not like using it if it has any complicated features.

Why do you need a portfolio tracker?

You must be managing this well on your own and thinking about why to download an additional app for managing your investment portfolio. But, the fact is that you would not have to switch between different apps with the portfolio trackers as you would get all the information here.

- Make sound spending decisions: The foremost rule of trading is knowing how much money to spend. It is very easy to cross the limit when you see the fluctuation in the market as there would be a time when you would want to invest more and more. But, you need to understand the amount of money that you are placing in. You would get all this information from the portfolio tracker, so pick the tracker that would help you make wise spending decisions.

- Better management: With the help of the tracker, you would be able to manage the different investments and keep a check on the budget. You need to know how much you can afford to lose, as managing your risk is the other side of spending. Various traders invest blindly and do not think about the risk involved with it. However, if you are a good trader, then your aim should be to stay in the game for a long, and you can do this by tracking your budget, which you can do with the help of the best investment tracking apps. These were some of the benefits of stock portfolio trackers, but which are the trackers that one should go for as they should have good speed, be reliable, cost-efficient, and possess excellent features. Is it attainable to have all of them in one tracker? Of course, it is. Here is the list of some of the excellent trackers which were created after a lot of research.

12 Best Investment Tracking Apps for Managing Your Portfolio

1) Delta Investment Tracker

It is a crypto-focused trading app available worldwide for Android and iOS users. It comes in both free and premium versions, you can initially opt for the free version, and if you like its features, then you can go for the premium plan. Features

You can get the live price changes to a huge range of stocks, bonds, mutual funds, ETFs, futures, options, and cryptocurrencies. It provides you with a summary of your total portfolio balance and your current market positions and value, percent change, and unrealized capital gains. Price change notifications You can also see the asset details and news for supported investments

Cons

It does not support commodities or mutual funds Intermittently slow

Thus, the Delta app is an excellent option for you as the majority of its features come for free, plus it is very user-friendly. So, if you want to see all your investments and trends in one place, then choose Delta that comes with dynamic capabilities. Also Read: 33 Best Cryptocurrency Exchanges

2) Sharesight

This platform offers you an amazing performance; here, you can track your shares and ETFs from more than 40 exchanges globally. On Sharesight, you would be able to track the performance of all your listed stocks automatically. This tracker is mainly for the users of the UK, New Zealand, Australia, and Canada customers. Features

Native crypto tracking Customizable tax reporting With the help of ShareSight, you can track 67 global currencies and follow unlisted, alternative investments like fixed interest and investment properties. Can also track multiple asset classes like currency, private equity, alternatives, bonds, property, and other custom investments in one place by using their features, called ‘custom groups’ Dividends tracking for supported stocks You also get price change alerts Can do a comparison against benchmarks

Cons

They offer a limited free version It is a mainly web-based solution

With the aid of this tracker, you would be able to know your actual performance of all the registered holdings, plus you can also view the result of dividends, capital gains, and currency variations. The premium plan commences at $12 a month.

3) Personal Capital

It is one of the best investment tracking apps available for both iOS and Android users. You would be amazed to know that it has more than 3 million users and this number is constantly increasing because of the excellent features and services they offer. Features

With Personal Capital, you can monitor your portfolios, plus your bills, bank accounts, credit card statements, taxable and retirement accounts as well Can get portfolio summary and category breakdown views You will get alerts whenever your holdings depart from the aspired portfolio balance. You also get recommendations for altering your asset allocation for improving the portfolio performance. They also render you with a mutual fund fees analysis tool Personal Capital also has an Investment Checkup tool and has a pretty good retirement calculator as well It also supports cryptocurrency tracking.

Cons

For US-based customers, only.

It comes in two versions, Free Financial Dashboard version and Wealth Management service, you can choose any as per your requirement. The best part is that you can use both versions for free.

4) Kubera

It is one of the most advanced portfolio trackers with thousands of bank connections and tracks all your assets in a single place. It provides you with all the detailed information about your investments and is perfect for newbies, real estate professionals, homemakers, and savvy crypt investors. Features

It helps equate your online brokerage accounts or can also combine individual stocks to note their value in real-time. You can also get the prevailing balance from your crypto wallets and exchange accounts. With the help of Kubera, you can connect with more than 20,000 banks globally to link your accounts. You can also combine your home value, any vehicles, or web domains you own to know the net worth. The assets can be added easily by just inserting a fresh row like a spreadsheet. Kubera has a unique characteristic called “Life Beat Check” that finds out for an outspread span of inactivity and can transfer your portfolio to a specific recipient.

Cons

The trial period is very less

It has a free 14-day trial. The premium version costs $15 a month or $150 a year. Also Read: 12 Best Penny Cryptocurrency to Invest

5) Stock Rover

This is a stock screener and analysis tool that is made particularly for learned traders. This app is available for iOS and Android; you can use it on your desktop, tablet, and mobile. The tracker helps you get in-depth information about your performance and offers portfolio analysis tools, trade planning, correlation tools, email performance reports, and re-balancing facilities. Features

On Stock Rover, you can get all the data offered by them without confusion You can combine all your brokerage accounts to this platform, but if you don’t want to attach your brokerage, you can put it manually or use a spreadsheet import It checks all these accounts on your behalf and provides you with automatic updates on the performance of your investments With Stock Rover, you can review your portfolio against benchmarks and make vital decisions using factual data instead of relying on your gut feel Once you’ve fixed the account with them, you will get daily, weekly, or monthly reports displaying your performance. You can use this data to analyze it for various metrics like risk-adjusted return, volatility, beta, IRR, Sharpe Ratio, etc.

Cons

Customer service is complicated as contact is by email only.

It has a free version and 3 paid plans: Essential- $7.99 a month, Premium- $17.99 per month, and Premium Plus- $27.99 per month.

6) Webull

It is one of the best stock portfolio trackers as it renders its users with live market data and supports full extended-hours trading. Webull is an online and mobile trading app that lets you trade in stocks, exchange-traded funds, and options. Features

With Webull, there is no account minimum, and stock trading is free. You can place pre-market trades from 4:00 am to 9:30 am and on regular trading days from 4:00 pm to 8:00 pm. Margin accounts give up to 4 times leverage on day trades, and on overnight borrowing power, it is up to 2 times. Customizing your homepage can be done, as you can pick the countries and regions you’re most intrigued in viewing and the stocks you’re tracing. Perfect for those seeking margin trading, day trading, and short sales. You can see real-time data tracking and price fluctuations Webull has a trading simulator that helps you know more about their trading platform and intensifies your investment abilities.

Cons

Customer contact is confined to email – no phone contact is available Does not promote fractional shares

It has zero trading commissions; there may be several regulatory and exchange fees imposed on transactions.

7) SigFig

It is one of the best free investment portfolio management software and application. Its user interface is simple, connects the accounts seamlessly, and automatically analyzes your portfolio. In addition, it helps determine if you are overexposed to any specific industry or company that helps diversify your investment and risk level. Features

It renders automated investing with economical management fees You get unlimited meetings with financial advisors SigFig offers innovative portfolio tracking tools Robust goal-based tools It automatically reviews your investment accounts from over 50 leading brokerages into one dashboard to provide you with a real-time view of the stocks, mutual funds, exchange-traded funds (ETF’s), and options you possess They also send you weekly email summaries of account performance, news that affects your portfolio, and notifications that aim at your top gainers and losers. Renders everyday audit to keep it on course with rebalancing, dividend reinvestment, and tax-efficient strategies.

Cons

No cash management or savings account.

SigFig provides free financial counseling. In addition, there is free management of the first $10,000 invested, but it has a $2,000 account minimum, which is higher than its competitors. Also Read: 10 Best Mutual Fund Apps to Invest Online in India

8) M1 Finance

On this app, you can see all your holdings just like slices of a pie. Your job is just to delegate a percentage to every slice, fund the app, and have a stocks portfolio. This app is actually as simple as it sounds, and the best part is that there is no broker fee, and there is no charge on commissions plus no minimum balance required for opening the account. Features

The platform integrates automated investment management with individual security selection. It is perfect for investors who want specialists to make all their stock judgments and for people who want to make a fully custom portfolio. M1 Finance lets you borrow against the credit line at a current rate of 2.0% You can select one of the 80 portfolio options built by the specialists It also provides you with an option to buy fractional shares; this means that you can buy a portion of a share instead of the whole shares

Cons

M1 Finance does not provide tax-loss harvesting

It does not charge advisory fees and commissions for trading

9) Yahoo Finance

It is a rich watchlist and one of the biggest business news sites in the US with data. Yahoo Finance is available on both online and web interfaces. This platform has a user-friendly design which means that you can easily track your commodities, bonds, stocks, bonds, and commodities. With Yahoo Finance, you can get personalized news and alerts as well. Features

Asset fundamental details, news, and commentary follow market movements in real-time quality data across multiple investment types Adjust the watch-list and get live quotes as you control your portfolio’s performance It offers investment research and screening tools Users also get quick access to this breaking information at a sight performance analysis

Cons

Its mobile app has a very primary portfolio tracking view

It comes in both free and paid versions; you can opt for the premium version after using the free version. Also Read: 120 Best Affiliate Programs

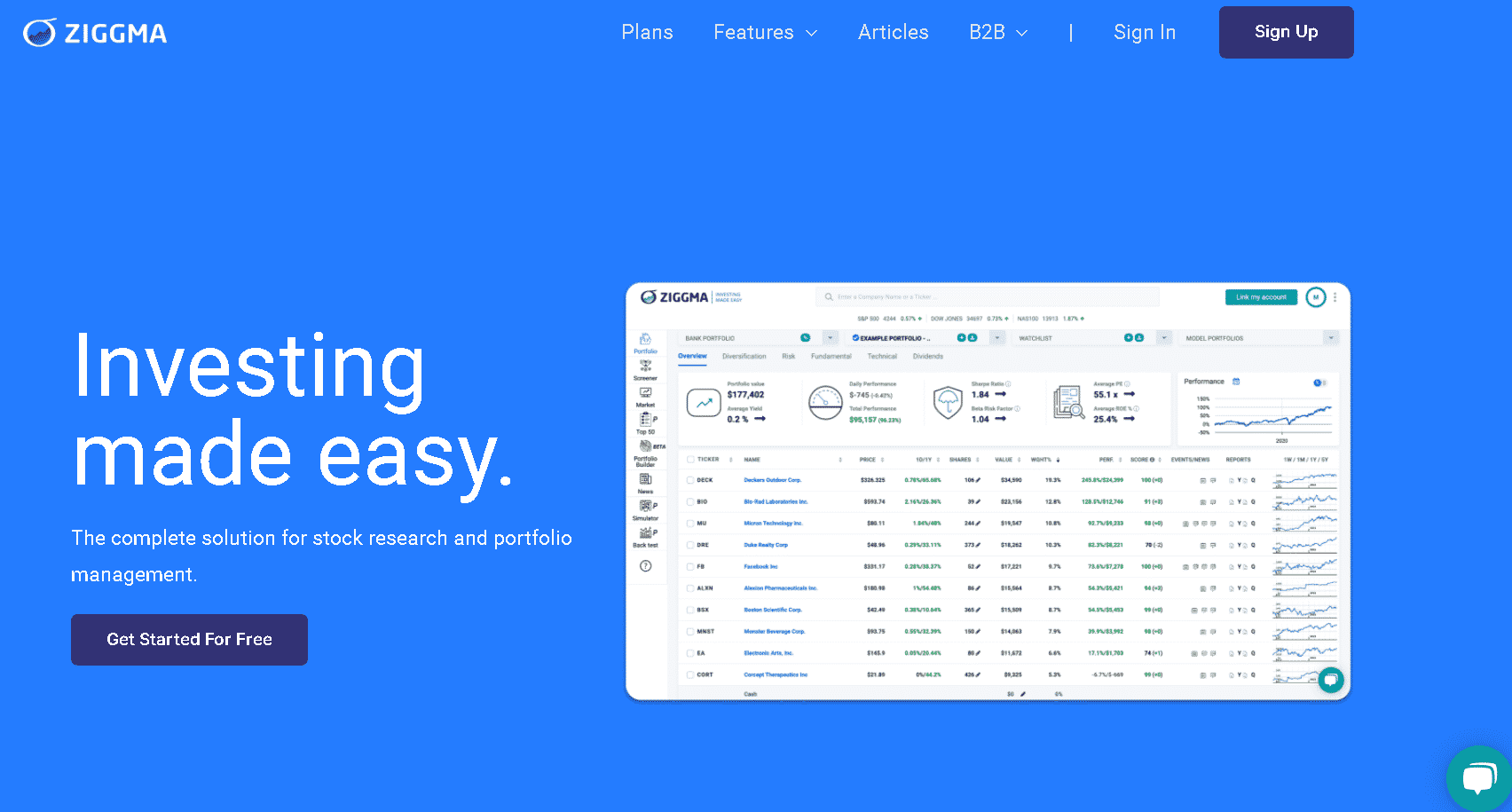

10) Ziggma

It is one of the best stock portfolio trackers created specifically for making investment and trading easy. Ziggma is also said to be the fastest stock and ETF screener in the market. There are many investors who cannot keep up with their investment portfolios as they fail to find good methods to optimize risk-adjusted returns. But, with the Ziggma portfolio tracker, you can find the best opportunities based on your long-term goals. Features

Portfolio Optimization Company Performance Scores Links your investment accounts Multi-Asset screener Monitoring tools Model portfolios to benchmark Intuitive portfolio analysis Account Aggregation

Cons

Customer contact is limited.

This app is perfect for beginners, active investors, and investors who seek opportunities.

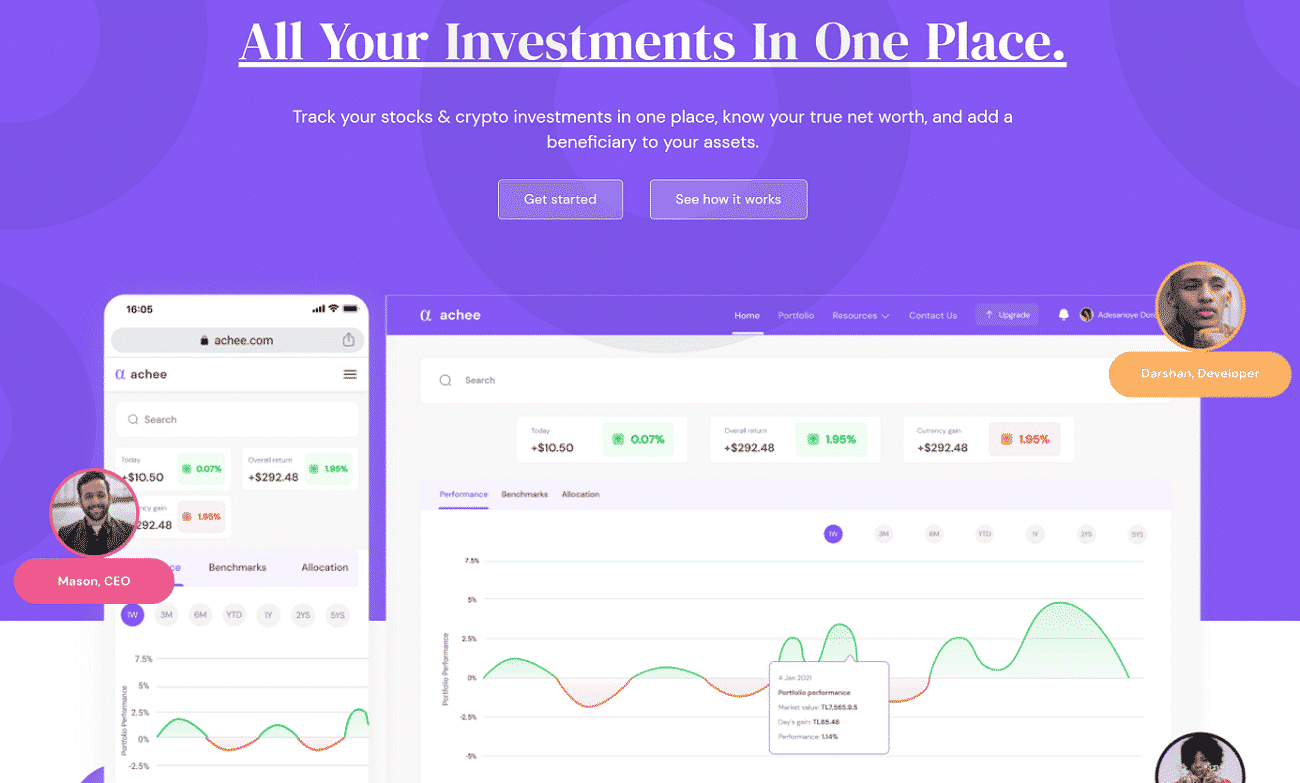

11) Achee

It is an excellent application to keep track of your investments and work out the true performance. There are a lot of things that you can do easily on achee, such as track investment costs, corporate actions, and the performance of your investment portfolio in your chosen currency. Features

It enables investors globally to track their investments flawlessly Achee backs 75+ stock exchanges, 5,000+ cryptocurrencies, and tokens It also enables you to track your fixed income instruments as well This platform has the ability to benchmark your returns against the leading index funds globally You can also get a portfolio health check and recommendations on areas to make your performance sound It deals in 170,000+ stock tickers, collected from 70 global exchanges, also includes Nasdaq, NYSE, and more.

Cons

Weak portfolio review aspects

This platform is apt for people who want to use the latest encryption technology standards as it helps safeguard your personal information. Also Read: Top 10 Largest Stock Exchanges in the World

12) TradeStation

This platform is available for desktop, iOS, and Android. You can trade numerous trading options like bonds, stocks, futures, and cryptocurrency, and futures. It is a great platform as its app is very user-friendly, and a beginner can also operate it without any help. TradeStation has numerous users, and the number is increasing because of the excellent features that it offers- Features

You get access to various power tools. With TradeStation, you can do commission-free stock, ETF, and options trades. There are stock and ETF screeners. Advanced charting abilities and trading simulators Comprehensive research Its robust desktop platform makes it an outstanding stock tracking app for PCs. It comes rigged with brokerage services plus trading education resources that big industry reviewers recognize

Cons

Plans and pricing can be complicated Free trading on an advanced platform demands TS Select.

This app is perfect for intermediate to advanced traders. Recommended: 22 Top Money Earning Websites These were some of the best stock portfolio trackers, but you should consider all the analytics tools you might wish to use when selecting a stock app. Irrespective of the platform you choose, portfolio trackers are a great way to track your investments easily from anywhere and at any time. Once you are using a tracker after that, you can focus majorly on making your investment portfolio grow.

![]()